Corporate Information

Management

| Chief Executive Officer |

Vivien Allen BA, DipMgmt, MAICD |

| Finance & Administration Manager |

Stephen Allinson BComm, CPA |

| Lending Operations & IT Manager | Michelle Battye |

| Member Services Manager | Ana Ramuta |

Board of Directors

| Chair |

Allison R Batten GAICD Allison is an experienced Board Director & Chair, Executive and Business Advisor. With a background deeply rooted in the retail sector, Allison had a successful corporate career having had senior executive roles with ASX listed Companies Target Pty Ltd and The Reject Shop Ltd. Since 2014 she has operated a private business consultancy supporting boards, CEO’s and C-Suite executives to deliver a broad range of projects which have included company financial health, strategy development, supply chain and logistics reinvention, and technology transformation and digitization. As well as spearheading M&A projects, Allison is adept at delivering complex contract negotiations. Allison is currently Chair of Geelong Bank where she has previously held the roles of Chair of both the Audit and Risk Committees. Allison also serves as Chair of the AICD’s Barwon South West Regional Forum. Previous Board roles have included as an executive member of the Board for The Reject Shop Ltd and as a board advisor to NQR Pty Ltd. Allison is a graduate of the AICD Company Directors Course, a graduate of the William & Mary Mason School of Business in strategic planning and management in retail and was a participant in the Senior Executive forum in leadership, strategy and Authenticity at AIM-UWA Business School in WA. A lifelong resident of Geelong and a proud advocator for the region. |

|

Deputy Chair |

Mark Burrowes Mark became a Director in October 2020. He is the Chair of the Governance Committee and a member of the Risk Committee. Mark is a Founding Director of Consigliere Pty Ltd, a family company advisory group. He is also a former Director of several Boards, including the Reach Foundation, the Starlight Children’s Foundation, as well as Managing Director of Medibank Private, Chair of Hardings Hardware and most recently Chair of Scope (Aust) Pty Ltd. He is a Fellow of the Australian Institute of Company Directors. As well as his Board experience Mark has had a 40 year corporate career across the oil sector, banking and finance, health, and retailing. Most recently he has been involved in company turnarounds and he continues to work in the field of Mergers and Acquisitions. He is a resident in the Greater Geelong region. |

| Directors |

Michael J Carroll Michael joined the Board as an Associate Director in 2016, before becoming a full Director in 2017. He is Vice Chair of the Board and Governance Committee and Chair of the Risk Committee. Prior to commencing his own consultancy business, Michael held a number of senior roles at GMHBA Limited and business, finance and administration roles with St John of God Health Care and Woodside Petroleum in Melbourne and Perth. Michael is an experienced Finance and Compliance executive with diverse industry experience across the Private Health Insurance, Health, Resources, and Investment Management sectors. His depth of experience extends across multiple disciplines including Accounting, Treasury, Company Secretarial, Information Technology, Commercial, Legal and Administration. He also a Non-Executive Director of St Laurence Community Services and a Director at GenU.

John Connor John joined the Board in 2021 as an observer before becoming a full Director in 2022. John has over 20 years' experience in financial services. His specialist areas are banking and insurance with a focus on capital, compliance and risk management. John has worked as an actuarial consultant at PricewaterhouseCoopers and in leadership roles at companies such as ANZ, Genworth and Westpac. John is an entrepreneur and a successful co-founder of multiple fintech's giving him a unique view on security and the effectively use of technology. John has a first class Master's Degree in Physics. He is also a Fellow of the Institute of Actuaries Australia (FIAA), a fellow of the Institute Faculty of Actuaries UK (FIA), a Chartered Enterprise Risk Actuary (CERA) and recently completed a graduate diploma in international relations.

Theodora Elia-Adams B Comm, CA, MTax, MAICD Theodora joined the Board in 2023 as an observer before becoming a full Director in 2023. She is a member of the Risk, Audit & Treasury Committees. Theodora is an experienced Non-Executive Director, Chair of Audit, Risk and Finance, and a highly accomplished Chartered Accountant and professional services executive having been a Senior Partner at Ernst & Young. She has been Non-Executive Director of ASX listed 4D Medical’s wholly owned subsidiary, ALHI Pty Ltd, and BioMelbourne Network, and is currently a Non-Executive Director at Australian College of Optometry, AUSVEG Ltd, and Building 4.0 CRC. Theodora is known for her strategic thinking and passion for constantly evolving and innovating, and for her ability to draw on both her executive and board experience to offer pertinent insights to strengthen an organisation’s governance posture.

Graham Fryer BEc. CA ANZ GAICD Graham joined the Board in 2023 as an observer before becoming a full Director in 2023. He is Chair of the Treasury Committee and a member of the Governance & Audit Committees. Graham is an experienced senior finance and operations executive specialising in finance, business improvement and structuring. Demonstrated people leadership capability developed through hands-on business management across many industries including Higher Education, Finance, Government and utility services. He has held CFO and COO roles and positions in major corporations as well as Board and Committee appointments. Graham provides this experience to organisations seeking an experienced interim executive during a transitional period.

John Velegrinis G Dip Bkg, FFin, MAICD John joined the Board in 2024 as an observer before becoming a full Director in 2024. He is a member of the Risk Committee. John is also a director of Bravery Trust and has over 40 years’ experience in financial services. John’s experience includes a number of senior executive positions at ANZ Banking Group for 30 years in commercial banking, including senior roles in corporate and institutional banking, risk management both domestically and internationally. Most recently John stepped down as CEO of State Trustees Ltd in July 2024 and prior to that CEO of Australian Scholarships Group where he oversaw the strategic transformation of activities to greater client centricity and digital focus for growth. This included significant experience and responsibility for Funds Management with a focus on member and client outcomes. |

The Board of Directors is responsible for the corporate governance of Geelong Bank. The Board guides and monitors the business and affairs of Geelong Bank on behalf of the members by whom they are elected and to whom they are accountable. An important feature of the Board is to ensure compliance with the prudential and solvency requirements of the Australian Prudential Regulatory Authority (APRA) and the Australian Securities & Investments Commission (ASIC).

The key responsibilities of the Board include:

- Approving the strategic direction and related objectives and monitoring management performance in the achievement of these objectives;

- Adopting an annual budget and business plan and monitoring the financial performance of Geelong Bank;

- Overseeing the establishment and maintenance of internal controls and effective monitoring systems;

- Ensuring all major business risks are identified and effectively managed;

- Ensuring Geelong Bank meets its legal and statutory obligations.

Directors of Geelong Bank are considered to be independent and free from any business or other relationship that could interfere with, or could be perceived to materially interfere with the exercise of their unfettered and independent judgement.

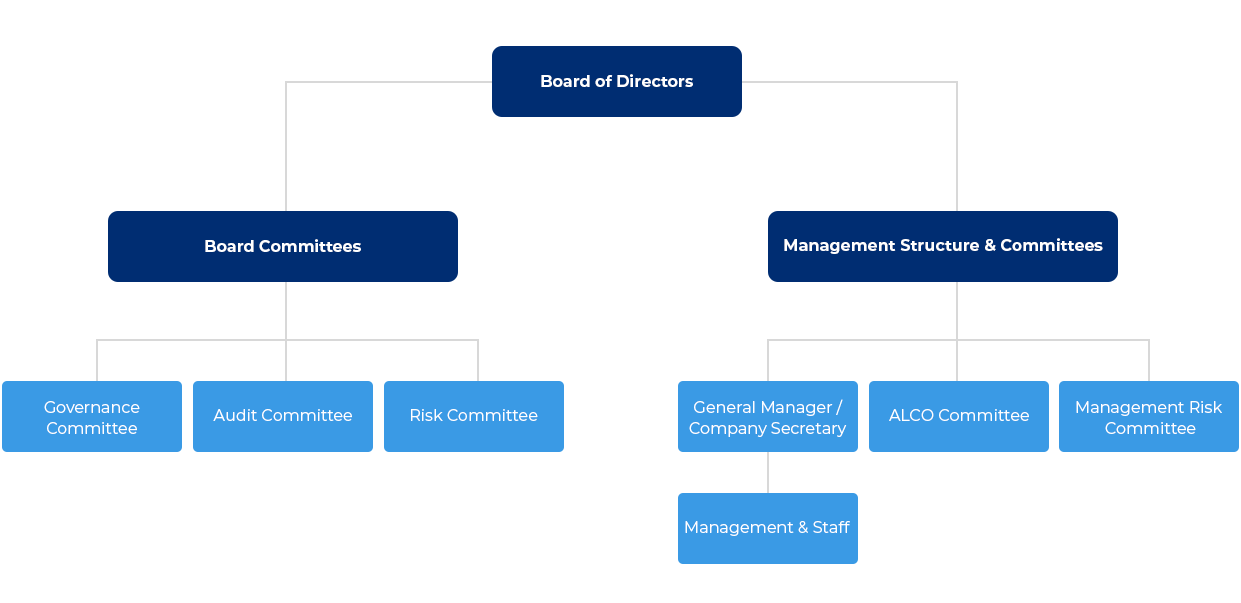

The Board has established the following committees which operate under a charter approved by the Board.

Governance Committee

The purpose of the Governance Committee is to assist the board in the exercise of effective corporate governance, including oversight of Geelong Bank's Governance and Fit & Proper Policies.

The purpose of the Governance Policy is to ensure strong Corporate Governance in the prudent management and financial soundness of Geelong Bank and in maintaining public confidence in the financial system.

The purpose of the Fit & Proper – Responsible Person Policy is to manage the risk to its business or financial standing that persons acting in Responsible Person positions are fit and proper.

The committee has also been appointed by the board to fulfil the role of the Nominations and Remuneration Committees incorporating board renewal, remuneration and nominations.

Audit Committee

The Audit Committee will assist the Board in fulfilling its oversight responsibilities and act as an interface between the board and the internal and external auditors. The Audit Committee will review:

- The system of internal control;

- The financial and regulatory/compliance reporting process; and

- The audit process.

Risk Committee

The Committee will assist the board in fulfilling its oversight responsibilities and will be responsible for:

- oversight of the risk profile and risk management of Geelong Bank within the context of the Board determined risk appetite (although ultimate responsibility for risk oversight and risk management rests with the Board, and the Committee will refer all matters of significant importance to the Board);

- making recommendations to the Board concerning the risk appetite and particular risks or risk management practices;

- reviewing management’s plans for mitigation of the material risks faced by Geelong Bank;

- oversight of the implementation and review of risk management and internal compliance and control systems;

- promotion of awareness of a risk based culture and the achievement of a balance between risk and reward for risks accepted.

Assets & Liabilities Committee (ALCO)

The ALCO is a committee responsible for managing the financial assets and liabilities of Geelong Bank. The committee recommends policy, sets strategy and monitors risks related to the management of Geelong Bank's assets and liabilities regarding:

- Pricing of the financial assets and liabilities including interest rates and fees;

- Interest margin;

- Interest rate risk;

- Funding and liquidity management;

- Investment management;

- Profitability and capital management.

The Board of Directors has implemented a Risk Management Policy which establishes the overall Risk Management Framework for managing operational risk. Specifically, the Risk Management Policy aims to:

- Contribute to profitable prudential performance by achieving an appropriate balance between realising opportunities while minimising losses.

- Maintain a comprehensive and up-to-date Risk Appetite Statement that addresses all material risks and sets the risk limits acceptable to the Board.

- Be concerned with risk as exposure to the consequences of uncertainty, or potential deviations from that which is planned or expected.

- Address Capital Management.

- Facilitate regular reporting to Senior Management, the Board and relevant committees.

Risk Management Framework

The Board of Directors has overall responsibility for the establishment and oversight of the risk management framework. The Board has established separate Audit and Risk Committees which are responsible for developing and monitoring risk management processes. The committee reports regularly to the Board of Directors on its activities.

Risk management policies and procedures are established to identify and analyse the risks faced by Geelong Bank, to set appropriate risk limits and controls, and to monitor risks and adherence to limits. Risk management processes and systems are reviewed regularly to reflect changes in market conditions and Geelong Bank’s activities.

The Audit and Risk Committees oversee how management monitors compliance with Geelong Bank’s risk management policies and procedures and reviews the adequacy of the risk management framework in relation to the risks faced by Geelong Bank. The Audit and Risk Committees are assisted in its oversight role by Internal Audit. Internal Audit undertakes regular reviews of risk management controls and procedures, the results of which are reported to the Audit & Risk Committees.

Geelong Bank has undertaken the following strategies to minimise risks.

Market Risk

The Bank is not exposed to currency risk, and does not trade in the financial instruments it holds on its books.

Credit Risk - Loans

The risk of losses from the loans undertaken is primarily reduced by the nature and quality of the security taken. The Board policy is to maintain at least 85% of loans in well secured residential mortgages which carry an 80% Loan to Valuation ratio or less.

The Bank has a concentration in the retail lending for members who comprise employees and family in the Ford Motor Company. This concentration is considered acceptable on the basis that the Bank was formed to service these members, and the employment concentration is not exclusive.

Should members leave the industry the loans continue and other employment opportunities are available to the members to facilitate the repayment of the loans.

Credit Risk - Liquid Investments

The risk of losses from the liquid investments undertaken is reduced by the nature and quality of the independent rating of the investee and the limits to concentration in one entity.

The Board policy is that investments shall be widespread to avoid any undue concentration of risk and all investments must be with financial institutions with a rating in excess of BBB- or higher.

Credit Risk - Equity Investments

All investments in equity instruments are solely for the benefit of service to Geelong Bank. Geelong Bank invests in entities set up for the provision of services such as IT solutions, treasury services etc where specialisation demands quality staff which is best secured by one entity.

Liquidity Risk

Geelong Bank has set out the maturity profile of the financial assets and financial liabilities, based on the contractual repayment terms.

Geelong Bank is required to maintain at least 9% of total adjusted liabilities as liquid assets capable of being converted to cash within 48 hours under the APRA Prudential standards. Geelong Bank's policy is to apply 15% of funds as liquid assets to maintain adequate funds for meeting member withdrawal requests. The ratio is checked daily. Should the liquidity ratio fall below this level the management and the Board are to address the matter and ensure that the liquid funds are obtained from new deposits and borrowing facilities available.

Operational Risk

Operational risk is the risk of direct or indirect loss arising from a wide variety of causes associated with Geelong Bank's processes, personnel, technology and infrastructure, and from external factors other than credit, market and liquidity risk such as those arising from legal and regulatory requirements and generally accepted standards of corporate behaviour.

Geelong Bank’s objective is to manage operational risk so as to balance the avoidance of financial losses and damage to Geelong Bank’s reputation with overall cost effectiveness.

Facebook

Facebook LinkedIn

LinkedIn Instagram

Instagram